Investors and company buyers:

IT and data as leverage in M&A, not as a risk

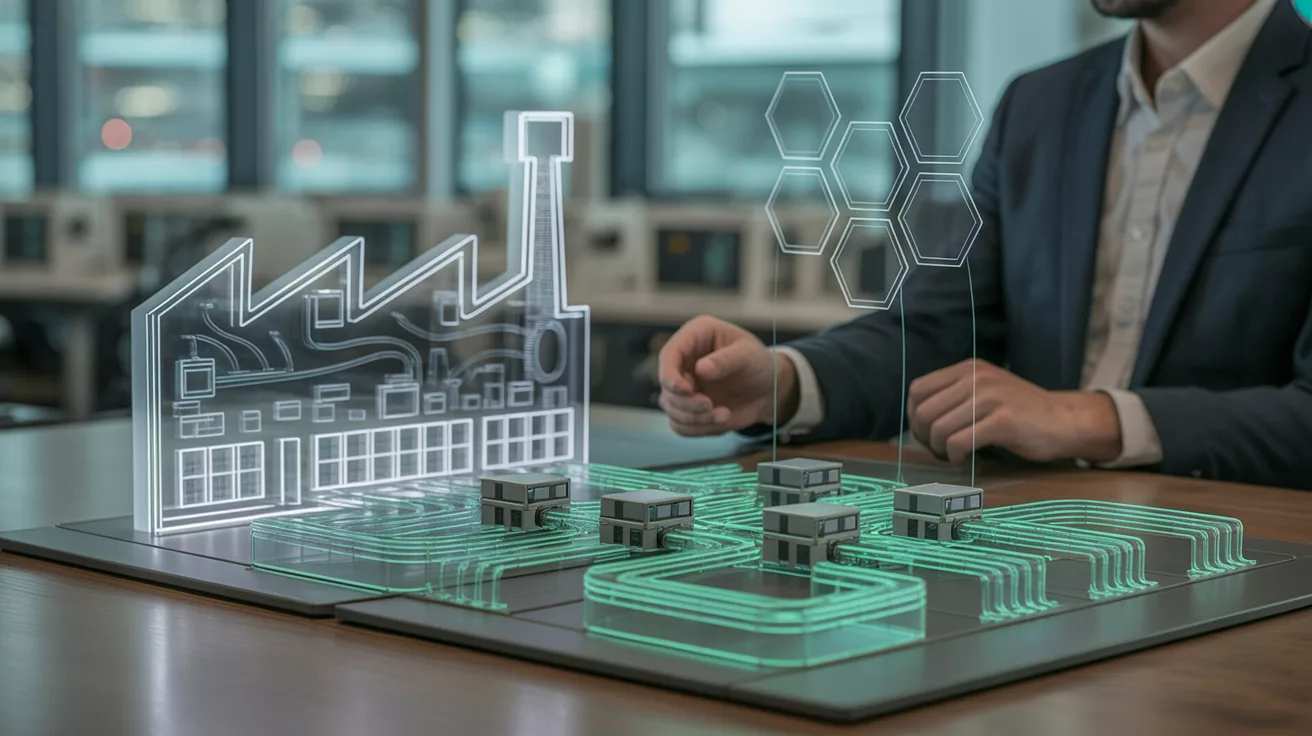

In industrial M&A transactions, IT and data landscapes are increasingly determining whether synergies are realized or risks become apparent.

Dategro supports investors, corporations, and strategic buyers in evaluating and integrating acquisitions in such a way that IT and data become enablers for value creation, rather than obstacles.

We combine deal logic with a clear focus on architecture, data models and governance – from due diligence through the first 100 days to a consistent group target vision.

Who this page is for

- regularly acquire industrial companies as a private equity firm, family office or corporate entity

- pursue a buy-and-build strategy with multiple platforms and add-ons

- as a strategic buyer, we want to integrate acquisitions into existing structures and make synergies measurable.

Typical challenges in industrial M&A

- IT and data risks are underestimated in due diligence and only surface later as costs and delays.

- Integration projects take longer, cost more, and deliver fewer synergies than planned.

- Reporting and KPI logics are heterogeneous across the portfolio.

- Acquisitions lead to an increasingly complex IT landscape that is difficult to manage.

- Digital initiatives and AI projects are encountering limitations in architecture and data quality.

What we do specifically for investors and company buyers

Our goal is to enable you to make M&A decisions with a clear picture of IT, data, integration and synergies – and to quickly integrate acquisitions into a consistent platform.

IT & Data Due Diligence for Industrial Targets

We analyze for you

- the target's IT and application landscape, including core systems, satellites, licenses and ongoing projects

- Data structures relating to customers, products, processes, quality, reporting and control

- Technical debt, legacy risks, and personnel dependencies in IT and data

- possible integration scenarios into your platform or existing portfolio companies

You will receive a structured due diligence report that clearly identifies the deal story, risks, capex/operex requirements, and integration effort across IT and data.

100-day IT & Data integration plan

We support you in this

- to define a target architecture that fits the group and digital strategy

- Planning integration paths, transition phases, and quick wins

- Define responsibilities, milestones, and KPI logic for the first 100 days.

- To manage risks in such a way that business and customer relationships are not jeopardized.

IT and application consolidation program across the portfolio

We are here to assist you

- to inventory systems, data and processes across multiple stakeholder groups

- to systematically identify synergy levers and consolidation potentials

- to develop a staged model in which you harmonize core systems, data models and KPIs.

- to set up a program that reconciles integration and standardization with the reality of the individual participations

Reporting, synergy tracking and evidence for investment boards

We bundle everything for you

- Key performance indicators (KPIs) on integration progress, synergies and risks

- Structured target images for IT and data architecture per stakeholder and at group level

- the most important implementation statuses and lessons learned from integration waves

- An evidence pack that you can use in investment committees, boards, and with financing partners.

What investors and company buyers gain from a collaboration with Dategro

- a significantly better view of IT and data risks already in the deal phase

- realistic integration plans that clearly address time, costs, and synergies

- a consistent IT and data target landscape for platforms and groups

- Key performance indicators and reports that make integration progress and value contributions measurable

- Fewer surprises after closing and a stronger position in negotiations and committees.

This is how a typical project starts

1. Initial consultation

2. Scoping

3. Implementation and evaluation

4. Bridge to implementation

FAQ for investors and company buyers

Yes. Dategro complements the work of your M&A, financial, tax, or commercial due diligence advisors with a clear focus on IT, data, and integration. We provide building blocks that can be integrated into the overall due diligence process.

We analyze architecture, application landscape, data models, governance, and risks as deeply as necessary for reliable decision-making. We address product-specific, highly technical details in collaboration with your IT teams or specialized partners.

Yes. Many engagements begin after closing, once initial integration phases have taken place and it becomes clear that a structured approach to IT and data is lacking. We can also start later and bring order to existing structures.

We work transparently, use clear language, and demonstrate how IT and data transparency simplifies the daily work of management. Measures are prioritized jointly with local management and not imposed "from above."

Our recommendations are vendor-neutral. We consider architecture, data logic, and control, taking existing systems into account. Specific product selection is carried out in separate steps, in which we can be involved if needed.

AI is an additional value driver when architecture, data foundation, and governance are sound. Therefore, when needed, we combine M&A services with the S6 AI Readiness & Use-Case Roadmap to specifically identify and prepare for AI potential in your portfolio companies.

If you would like to supplement your M&A strategy in the industrial environment with a clear view of IT and data, we can start with a focused M&A discussion.

In this discussion, we will clarify your platform and buy-and-build strategy and determine which components from the Dategro service catalog – in particular M1 to M3 – have the greatest leverage for low-risk acquisitions and faster value realization in your case.

Dategro partners with deal teams to conduct targeted technical due diligence that identifies hidden IT risks, quantifies their impact on valuation, and creates clear remediation roadmaps—all within standard deal timelines.

COMPANY

dategro IT GmbH & Co. KG

In der Gelpe 79

42349 Wuppertal

Germany

E-Mail:

[email protected]

Telefon:

0202 430 427 20